How it works

When household items fail, they often require sophisticated diagnostic tools and skilled technicians to oversee a potential repair – the costs of both can add up quickly. Equipment breakdown coverage protects your customers against unexpected repair or replacement costs due to a mechanical, electrical or pressurized system breakdown.

Equipment breakdown coverage costs just $2 a month and offers coverage for up to $50,000 with a $500 deductible per occurrence. Any claims made under this coverage option will have no impact on future premiums or agent profit sharing.

This coverage covers the extra costs necessary to expedite repair or replacement, so your customer’s life can quickly get back to normal. Your policyholder will simply need to call their own trusted repair vendor to get their equipment fixed.

After a loss, the coverage provides for a “greener” replacement by covering the additional cost to replace non-Energy Star equipment with Energy Star-rated equipment (up to an additional 25% of the replacement value of the original equipment). This provision does not increase any of the applicable coverage limits or apply to any actual cash value loss settlement.

In addition, if a home becomes uninhabitable due to equipment breakdown, temporary living arrangements are covered. This is a benefit most warranties and service contracts don’t offer.

What’s covered and what’s not

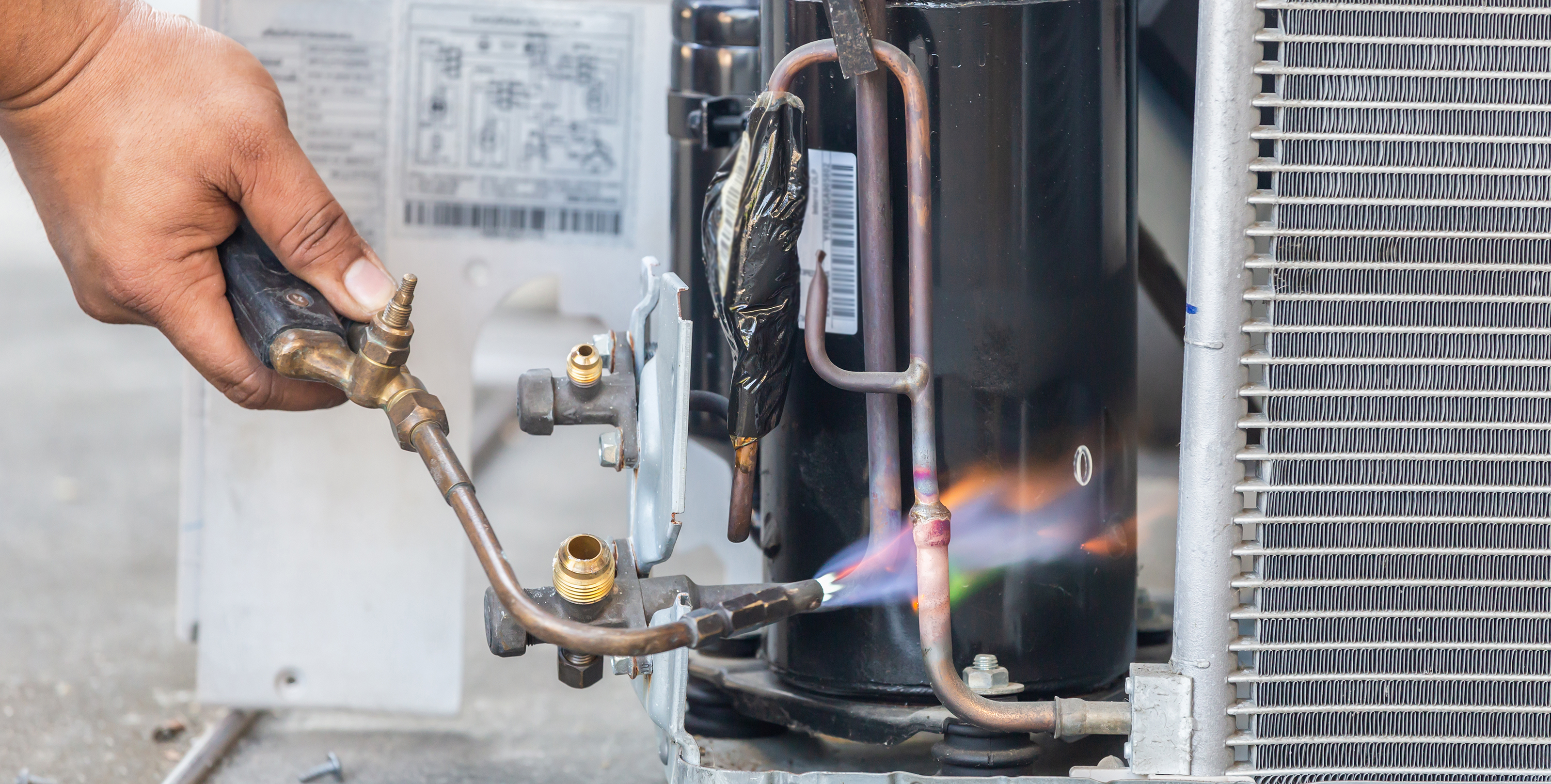

Equipment breakdown coverage covers common appliances and systems that people use in their homes, such as:

|

|

|

With equipment breakdown coverage, losses must be sudden, direct and accidental. Overall wear and tear – the natural deterioration of a machine’s ability to perform its intended function – is specifically excluded from this coverage.